As part of Stakeholders Magazine’s commitment to empowering businesses and fostering community resilience, we’re sounding the alarm on a growing scam targeting business owners who accept payments via OPay. Our Corporate Social Responsibility (CSR) initiative aims to protect merchants like you from financial losses and operational disruptions. Stay vigilant and safeguard your livelihood with this critical information.

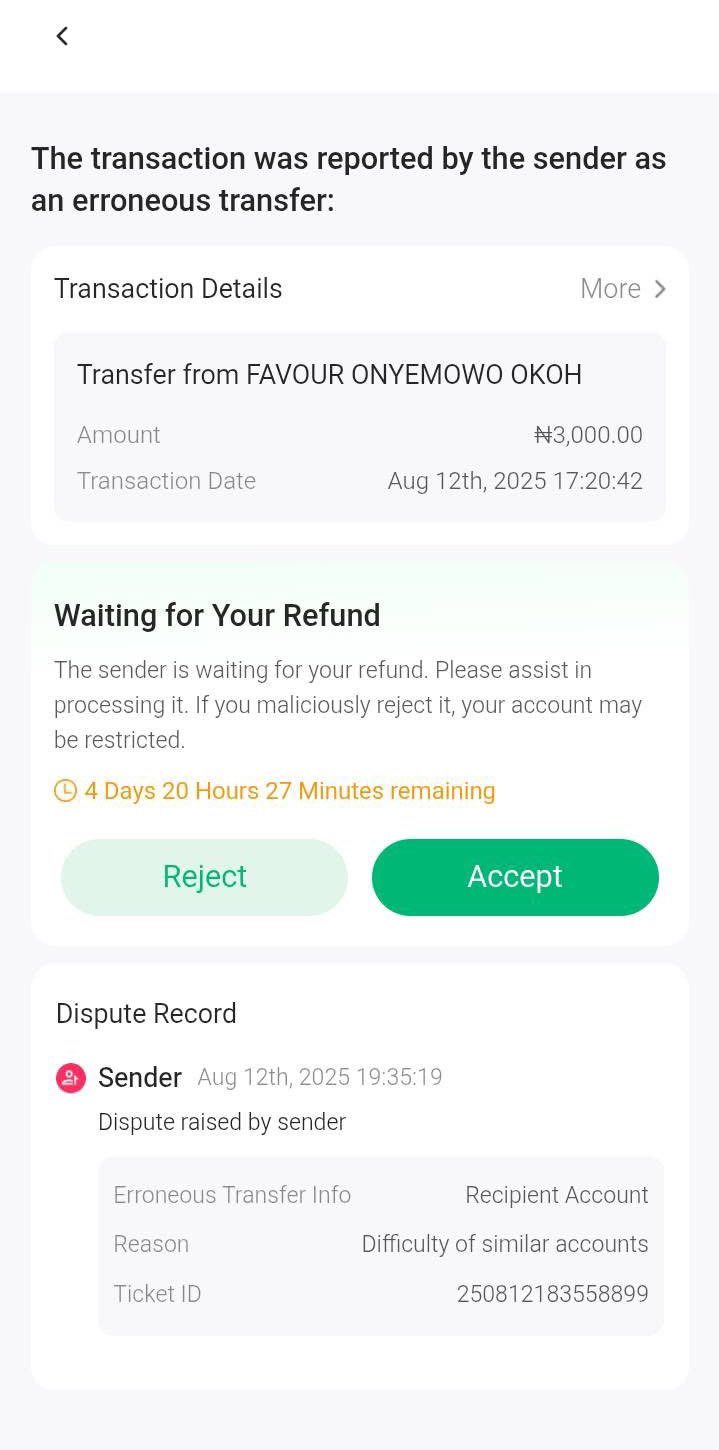

Fraudulent customers are exploiting OPay’s refund process in a deceptive scheme. Here’s how it unfolds: a customer purchases goods or services and pays using their OPay account. Later, they falsely claim the transaction was an error or the amount was incorrect. OPay then notifies you to process a refund, often with a tight deadline. Failure to comply risks account restriction and resolving disputes through OPay’s customer service can be a frustrating ordeal, often leaving merchants stuck in endless chatbot loops.

To shield your business, adopt these protective measures. Always require customers to include a clear payment description or purpose in the transaction narration when transferring funds via OPay. For instance, insist on details like “Payment for 3 shirts” or “Invoice #5678” to create a verifiable record. This simple step makes it harder for scammers to dispute legitimate transactions. Additionally, maintain thorough records of all sales, including receipts and customer communications, to strengthen your position in disputes. Regularly review your OPay transaction history to quickly identify and address suspicious activity.

If you receive a refund request from OPay, act promptly but cautiously. Verify the transaction details—payment narration, amount, and customer information—against your records before processing any refunds. If anything seems amiss, contact OPay’s customer service immediately, documenting all interactions to support your case. While navigating customer service can be challenging, persistence is key to protecting your account.

Stakeholders Magazine is dedicated to supporting businesses through education and awareness. This scam highlights the need for vigilance in digital transactions. By enforcing clear payment narrations and staying proactive, you can minimize risks and keep your operations running smoothly. Share this CSR public service announcement with fellow merchants to build a stronger, scam-resistant business community.

OPay remains a valuable tool for seamless transactions, but staying informed is your best defense. For more resources on securing your business, visit Stakeholders Magazine online or connect with your local business association. Together, we can outsmart fraudsters and ensure your business thrives