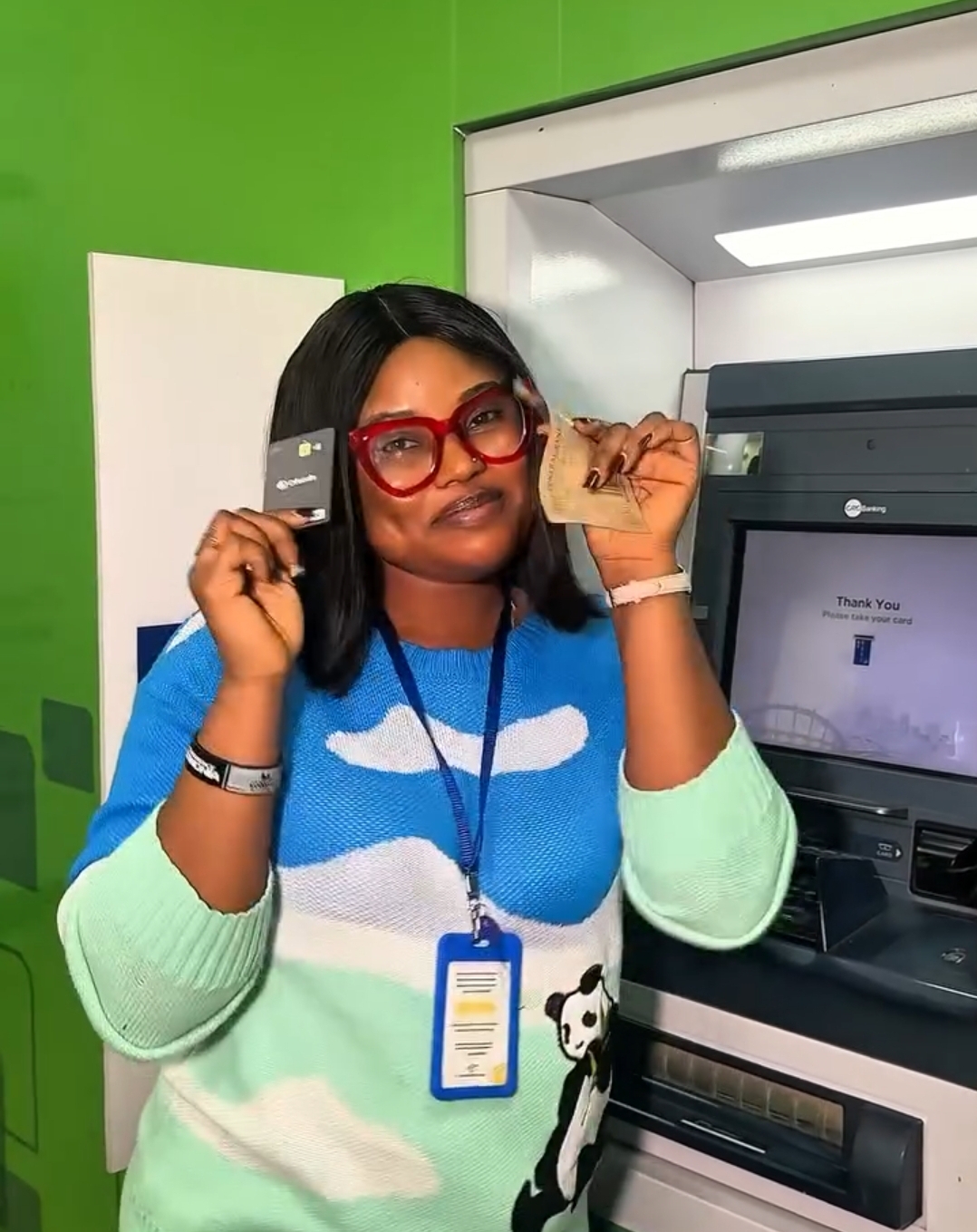

Blord Group, led by renowned entrepreneur Linus Williams Ifejirika, popularly known as Blord, has unveiled Ofunds, the first crypto-linked physical debit card in Africa. The announcement, made via Blord’s Instagram handle (@blord_official) on August 20th,2025, marks a significant milestone in bridging the gap between digital currencies and traditional financial systems, positioning Blord Group as a trailblazer in the region’s rapidly evolving fintech sector.

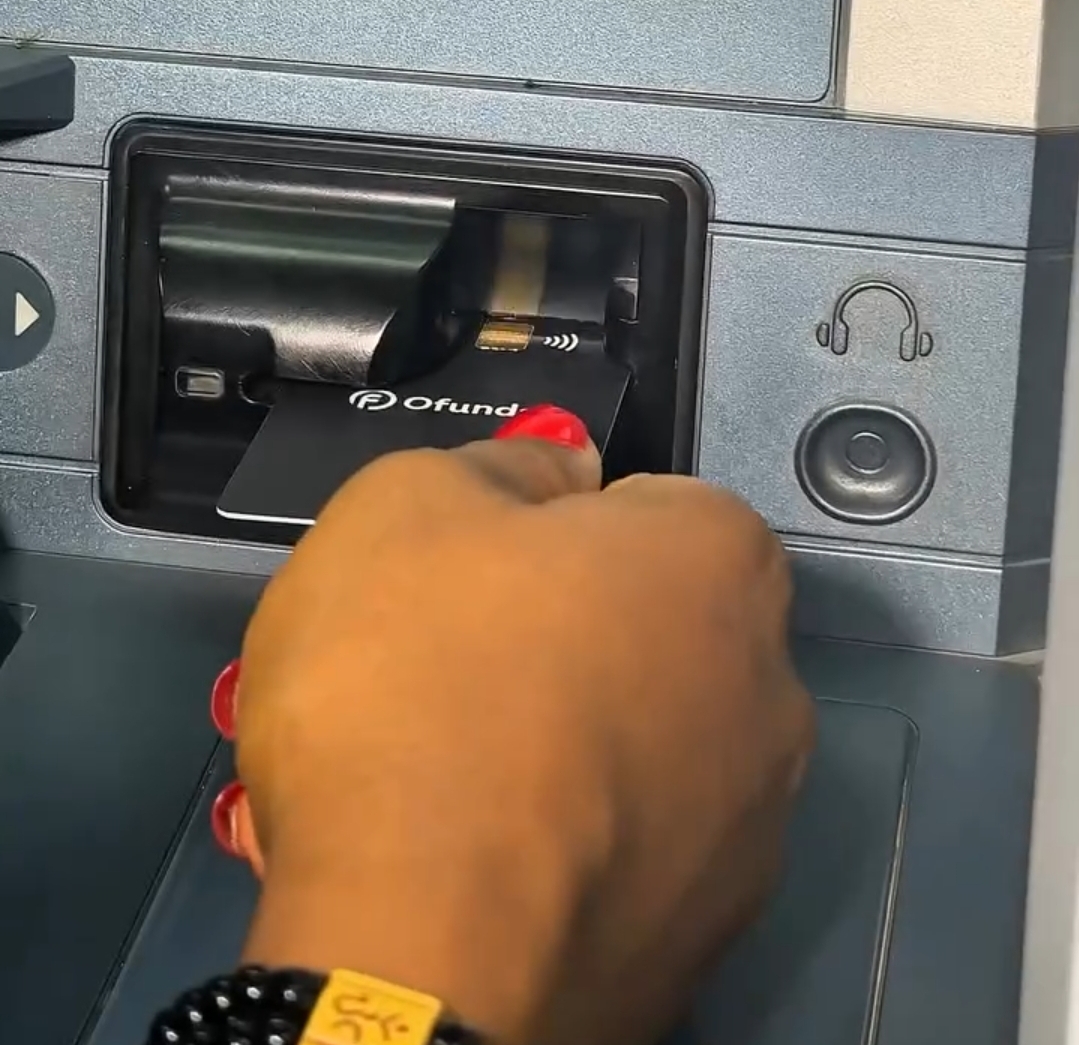

Blord shared a post on Instagram, stating, “Connecting crypto to physical debit card: A crazy project I built in silence.” He further revealed that no other crypto app in Nigeria currently offers a physical debit card, underscoring the pioneering nature of Ofunds. To demonstrate the card’s functionality, Blord personally drove around Lagos, testing it at local POS operators. According to his statement, the Ofunds debit card supports a daily withdrawal limit of N1 million, offering users unprecedented flexibility to access their cryptocurrency holdings in real-world transactions.

The Ofunds debit card is a game-changer for Nigeria’s crypto ecosystem, where regulatory challenges and limited integration with traditional banking have often hindered the practical use of digital currencies. By enabling users to fund their cards with cryptocurrency and spend it seamlessly at POS terminals, ATMs, and potentially online, Blord Group is addressing a critical need for accessibility and convenience in the crypto space. This innovation builds on the company’s recent acquisition of a U.S. Dollar virtual card license in August 2024, which allowed funding with both crypto and Naira, signaling their strategic push into advanced financial solutions.

Blord Group, already a leader in Nigeria’s fintech industry with platforms like JetPay (for crypto-to-cash conversions and gift card trading) and BillPoint (for bill payments), has a customer base exceeding 5 million. The introduction of Ofunds further cements its reputation for delivering customer-centric, innovative solutions. The physical debit card aligns with the growing global demand for financial products that integrate cryptocurrencies with everyday spending, a trend seen in other markets but previously absent in Nigeria.

However, the launch comes amid scrutiny of Blord Group’s operations. In July 2024, Linus Williams faced allegations of cryptocurrency fraud, terrorism funding, and non-compliance with Central Bank of Nigeria (CBN) regulations, leading to a brief detention by the Nigeria Police Force. Blord was released on bail, and his company denied the allegations, asserting compliance with legal standards. Despite these challenges, Blord’s bold move with Ofunds demonstrates confidence in the company’s vision and its ability to navigate Nigeria’s complex regulatory landscape.

The Ofunds debit card is poised to appeal to Nigeria’s tech-savvy youth and crypto enthusiasts, offering a practical solution for converting digital assets into usable funds. With a reported net worth of $300 million, Blord’s influence as a crypto mogul, and his 3.4 million Instagram followers amplify the potential reach of this innovation. Stakeholders in Nigeria’s fintech and crypto sectors are watching closely, as Ofunds could set a precedent for other companies to follow, potentially reshaping the country’s financial ecosystem.

For more details on Ofunds and its rollout, stakeholders are encouraged to visit Blord Group’s official website (blordgroup.ng) or contact their business line at +2347044175144. As Nigeria continues to emerge as a hub for cryptocurrency adoption, Blord Group’s Ofunds debit card represents a bold step toward a future where digital and traditional finance converge seamlessly.