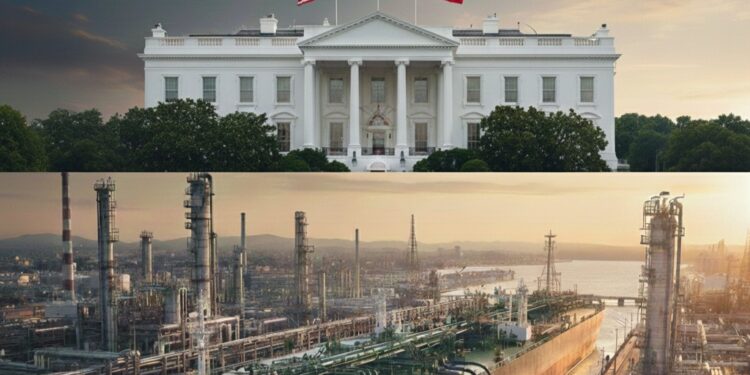

WASHINGTON D.C. / CARACAS — In a move that has stunned global energy markets and sent legal scholars into a tailspin, President Donald Trump has announced that the United States will take immediate delivery of 30 to 50 million barrels of Venezuelan oil. The deal, brokered with “Interim Authorities” following the weekend capture of Nicolás Maduro, carries an unprecedented stipulation: the resulting revenue—estimated between $1.8 billion and $3 billion—will be managed directly by the President himself.

A New Architecture for Energy Geopolitics

A New Architecture for Energy GeopoliticsFor stakeholders, the implications are immediate and transformational. By bypassing traditional diplomatic and energy-trading channels, the President has effectively established a “Personalized Petroleum Trust” overseen by the Oval Office. This shift from a policy of “maximum pressure” to one of “direct management” marks a new era in how the U.S. utilizes foreign energy reserves as a tool of statecraft.

“This Oil will be sold at its Market Price, and that money will be controlled by me, as President… to ensure it is used to benefit the people of Venezuela and the United States!”— President Donald Trump via Truth Social

The Rush to Rebuild

The Rush to RebuildThe President has tasked Energy Secretary Chris Wright with executing the logistics. Wright is expected to meet with top-tier oil executives at the Goldman Sachs Energy Conference in Miami this week to discuss a “reimbursement-through-

The administration is pressuring Energy Majors like ExxonMobil, Chevron, and ConocoPhillips to reinvest billions to repair “badly broken” infrastructure. While the potential for recovery of assets nationalized decades ago is enticing, industry insiders remain cautious. Firms are seeking ironclad legal guarantees before committing capital to a region where the political future remains shadowed by uncertainty.

Market Realities and Refiner Upside

Market Realities and Refiner UpsideWhile the political narrative is dominated by the White House, the economic reality is being felt on the U.S. Gulf Coast. These refineries, specifically engineered to process Venezuela’s “heavy sour” crude, stand to gain a reliable, sanctioned-free feedstock. This influx could significantly lower logistics costs and increase efficiency, turning a geopolitical shock into a bottom-line advantage for domestic refiners.

The Legal and Global Fallout

The Legal and Global FalloutThe “direct control” of sovereign funds is already raising red flags among legal and compliance experts. The prospect of the U.S. Executive branch managing foreign state revenues challenges established international norms and could trigger a wave of litigation regarding “who owns the oil.”

Furthermore, the geopolitical friction is mounting. By diverting these barrels to U.S. docks, the administration is effectively cutting off supply lines to China, traditionally the largest buyer of Venezuelan crude. This move signals Trump’s intent to establish the U.S. as a world-leading energy superpower, even as it risks further straining relations with Beijing.

What’s Next for Stakeholders

What’s Next for StakeholdersAs the first “storage ships” prepare to unload at U.S. docks, the message to the market is clear: the Venezuelan oil sector is no longer just an extraction business—it is a high-stakes experiment in direct executive oversight. Investors must now watch for the specific terms of the “reimbursement” contracts and the official response from the Chinese Ministry of Foreign Affairs.